Every August, Forbes and BVP publish the Cloud 100 list, highlighting the most valuable private SaaS & Cloud companies.

I love analyzing this list.

Each year I publish my Cloud 100 spreadsheet (free to download, enriched by Keyplay) and share my take-aways.

It’s a great way to spot themes and find role models.

Let's look at how this year's Cloud 100 differ from peers, what’s trending, and highlight clues about the modern SaaS playbook.

Here’s what stood out from 2024...

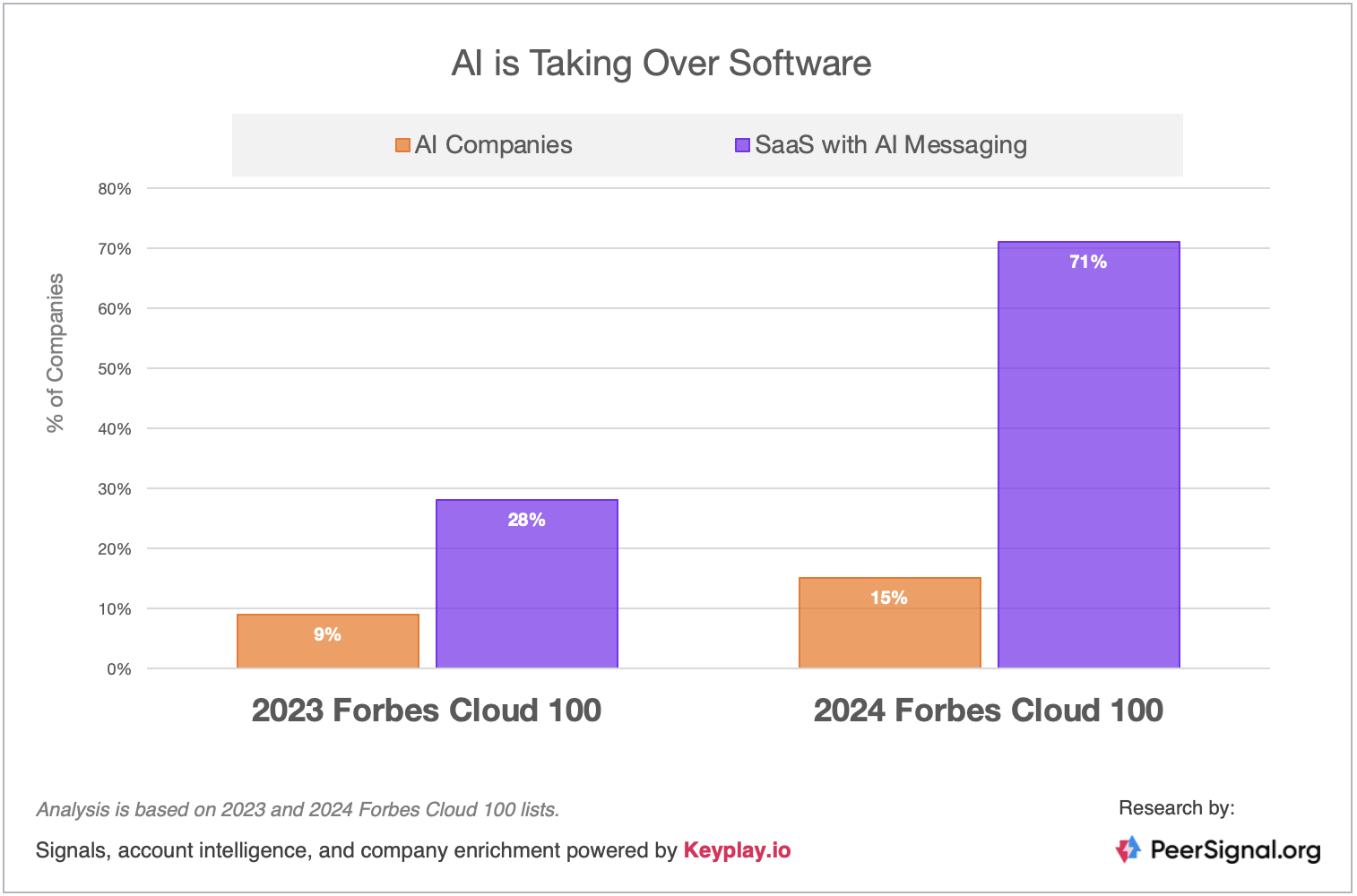

AI is Eating Software

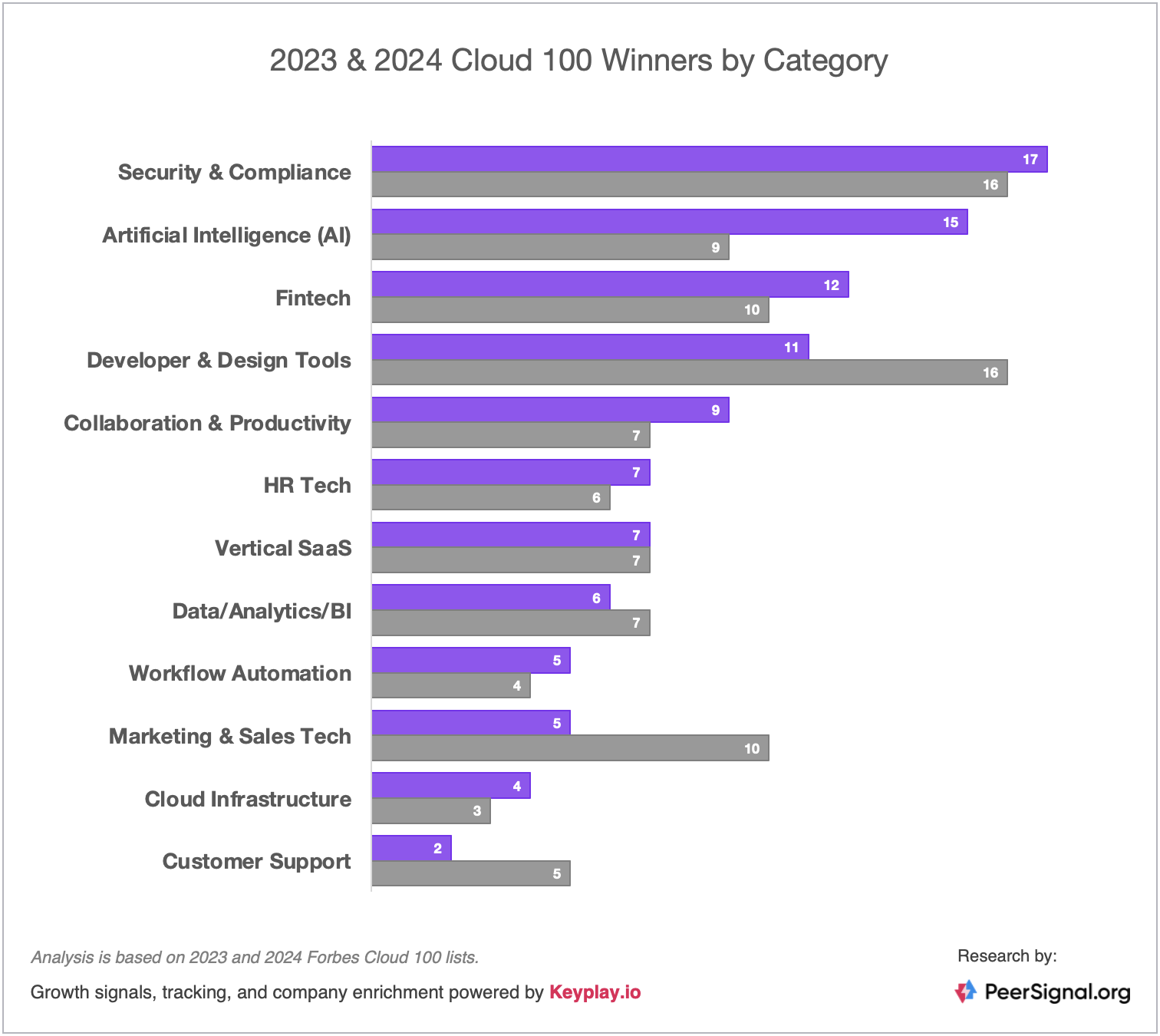

Investors are doubling down on AI. Last year, 9% of winners were AI companies; this year, it’s a whopping 15%.

AI isn’t just a category — it's becoming core to software business across every category. In 2023, 28% of Cloud 100 companies mentioned AI in their main headlines and company descriptions. In 2024, that number jumped to 71%.

OpenAI leads with the highest valuation, but they’re not alone. New additions like Abridge, Perplexity, Glean, and Mistral AI showcase the growing dominance of AI in the industry.

Hiring Like It’s 2024?

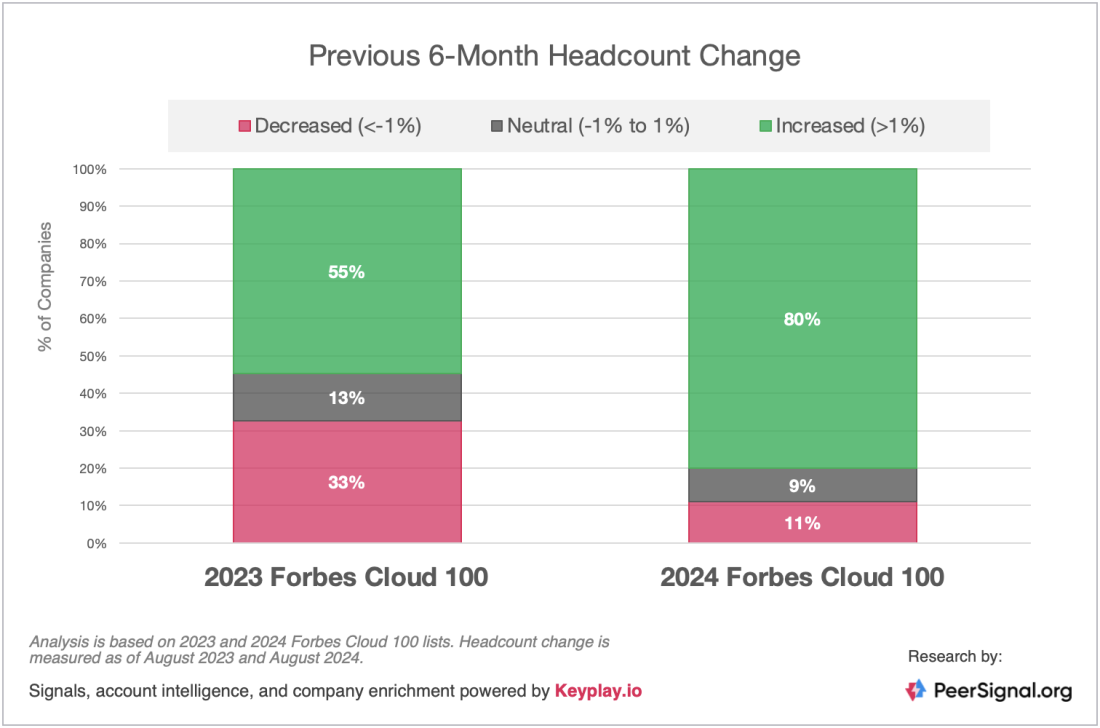

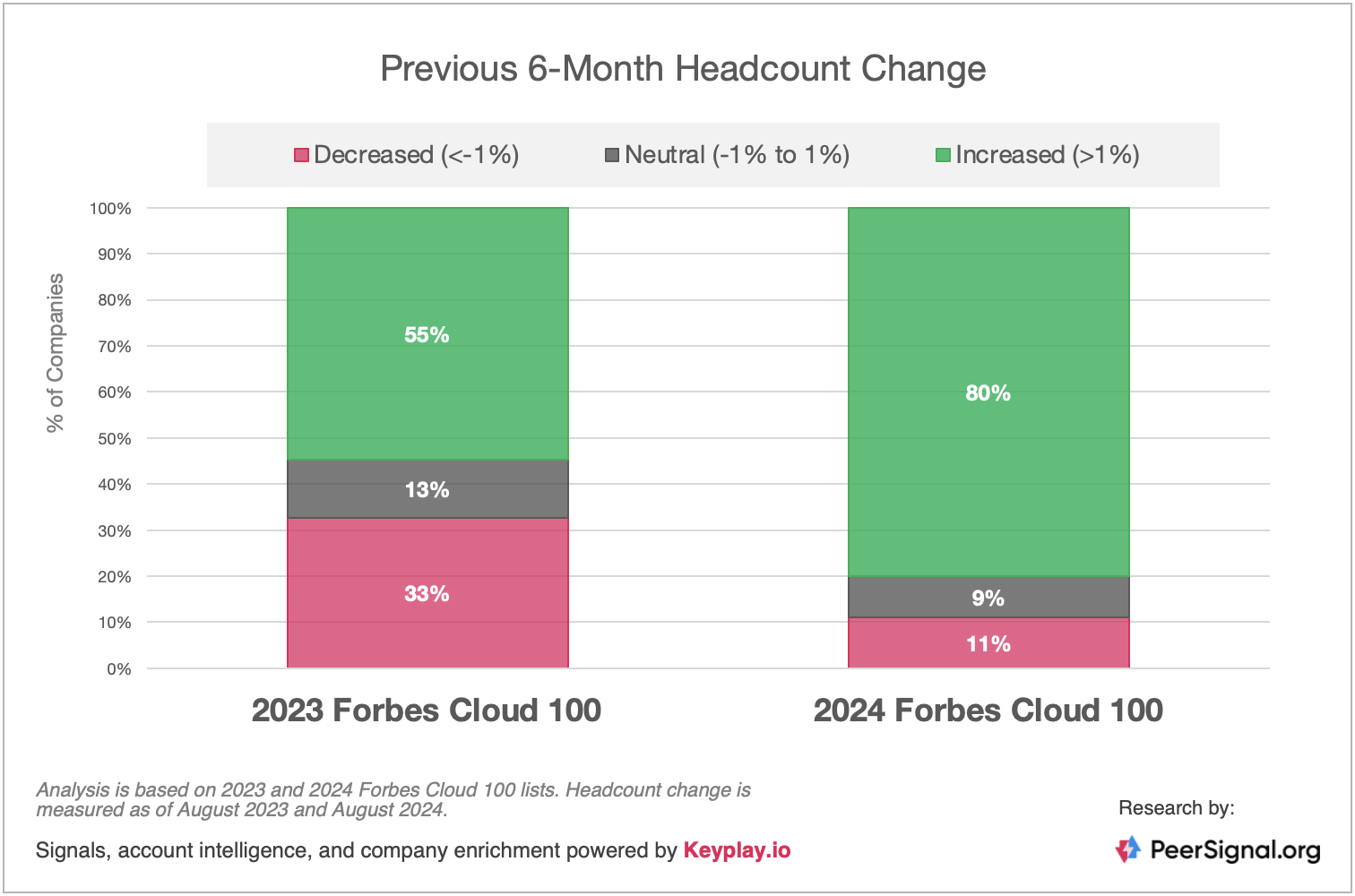

Even the Cloud 100 felt the 2022-2023 SaaS correction. The winners appear to be back to hiring and growth.

|

Last year, 33% of these companies had reduced headcount over the previous six months. Only 55% had a net increase, and 13% were neutral. This year, the tables have turned. 80% have increased headcount in the previous six months, with only 11% reducing and 9% staying neutral.

Open roles have surged, increasing by 66% year-over-year from ~4,400 to ~7,300. I don't think we'll go back to the "growth at all costs" days of 2021, but perhaps we've reached a new normal.

B2Bs Can Build with Strong Brands

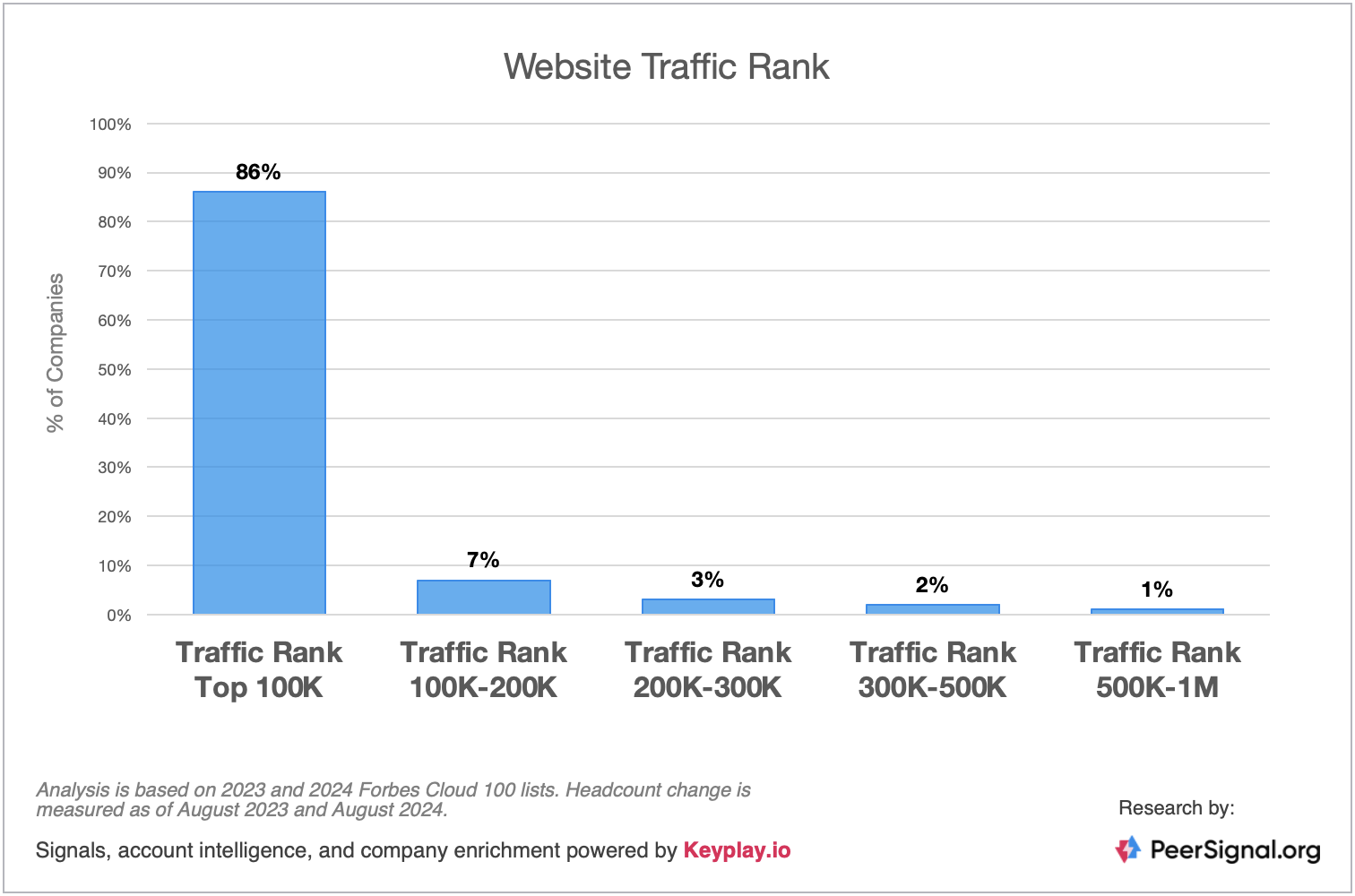

Top Cloud 100 companies may sell enterprise software (i.e. they aren't Vuori or Liquid Death), but they’re building powerful brands that extend well beyond their niche markets. On average, they have an impressive 250,000 LinkedIn followers. A significant 86% of these companies rank in the top 100,000 for website traffic, and another 12% fall within the 100,000 to 500,000 range. That's a lot of reach and online audience.

|

Their brand strength ties directly into their PLG, Community, and Ecosystem strategies (more on that below), significantly impacting audience reach and influence.

Security Winners Keep Coming

Security continues to dominate. Seventeen percent of this year’s Cloud 100 are in the Security & Compliance category, making it the biggest category in the Cloud 100, evening edging the hot AI category by two companies.

|

These "boring" problems translate to big money. The fast-paced nature of this category is evident—Wiz, for instance, turned down a $23B offer from Google just a few years after its founding.

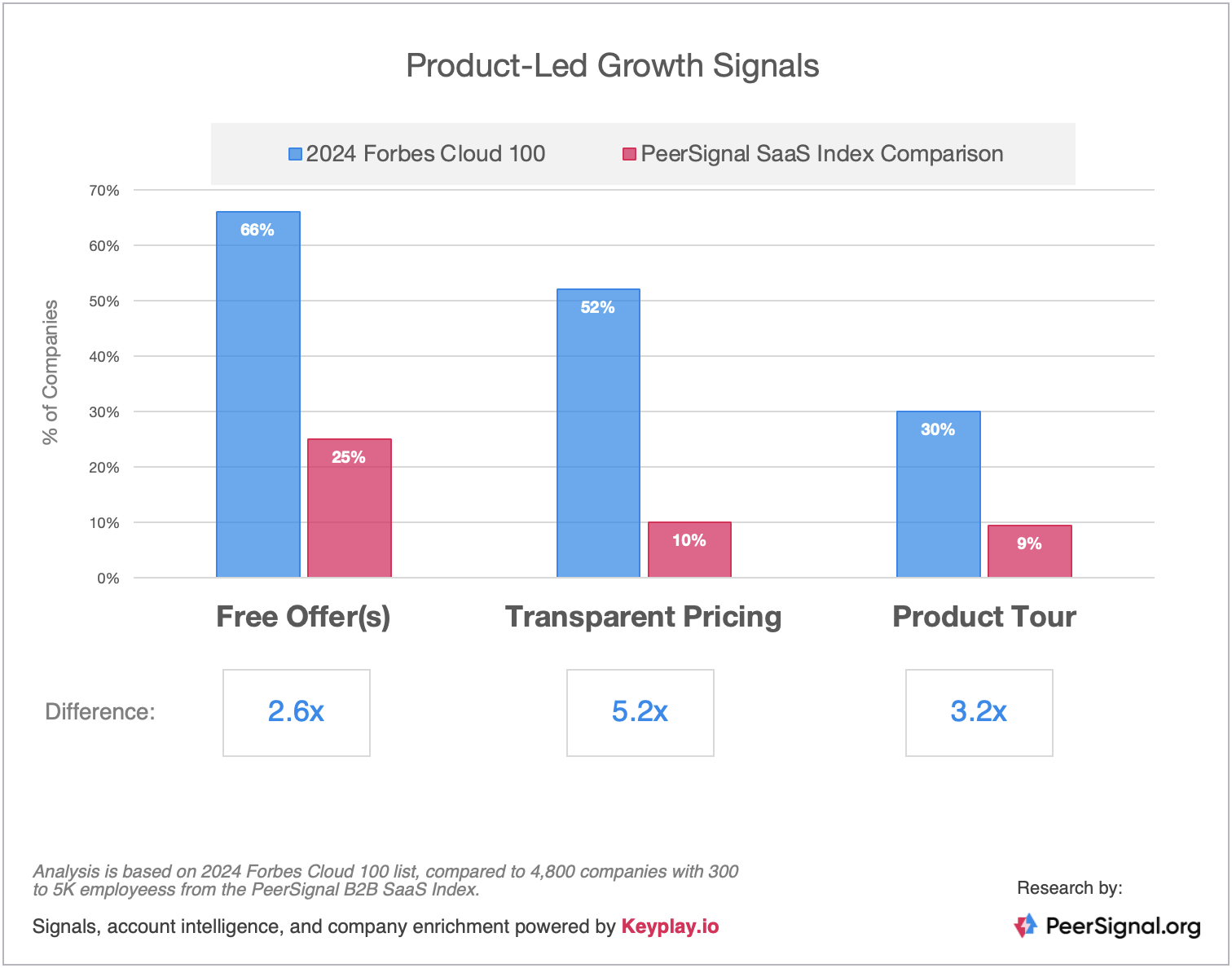

PLG by Default

Product-led growth is now the standard for Cloud 100 companies. SaaS leaders are well-versed in the needs of modern B2B buyers.

|

66% have a free plan or free trial, 2.6x more than our SaaS index. 52% have transparent pricing, 5.2x more than their peers.

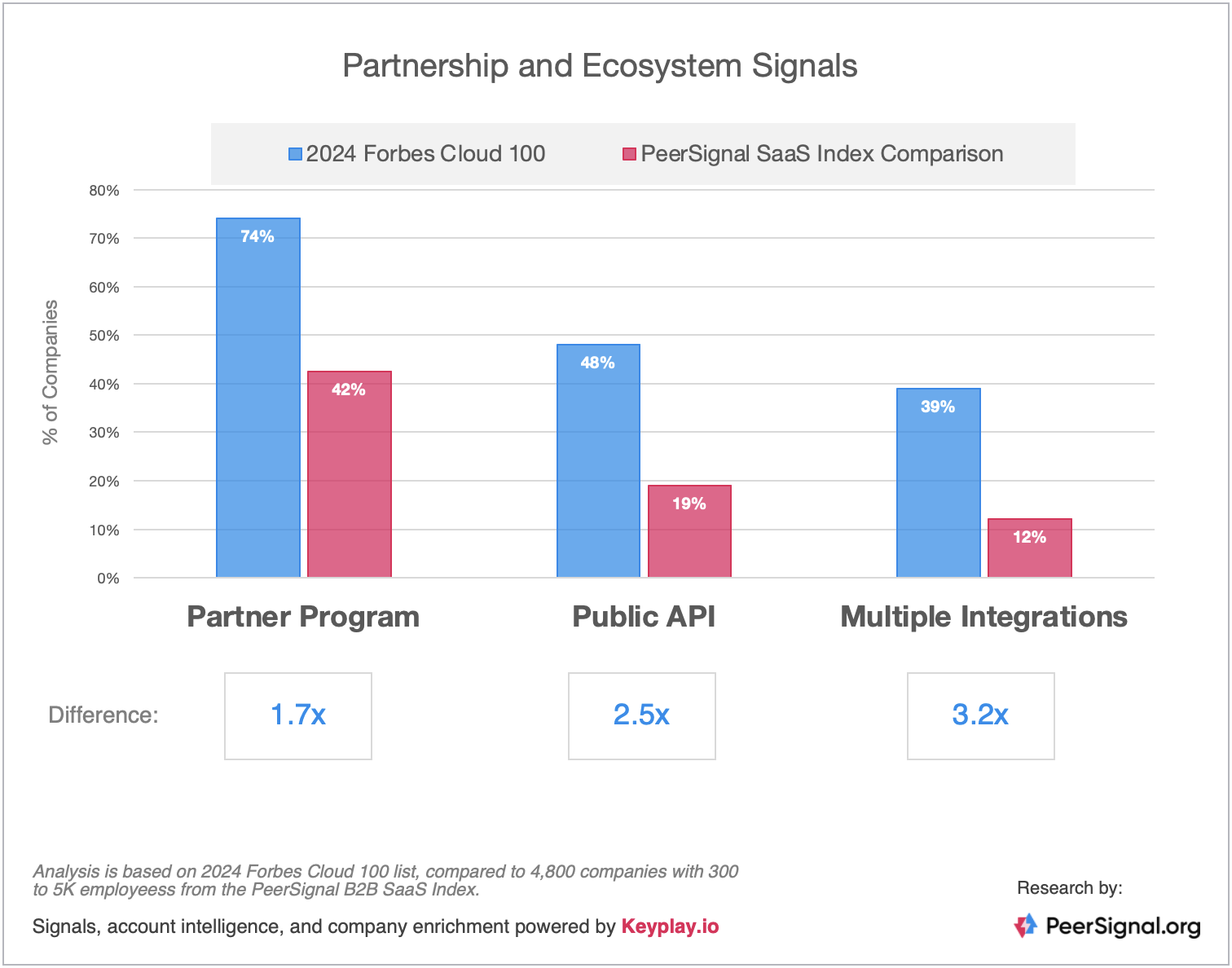

Partners, Ecosystems & Integrations

Cloud 100 companies are deeply invested in their ecosystems.

|

74% have a Partners page, 1.7x the comparison group. 48% have a public API, 2.5x the comparison group. 39% list multiple integrations, 3.2x the comparison group.

This trend is consistent with last year’s list, emphasizing the importance of partnerships and integrations in scaling SaaS businesses.

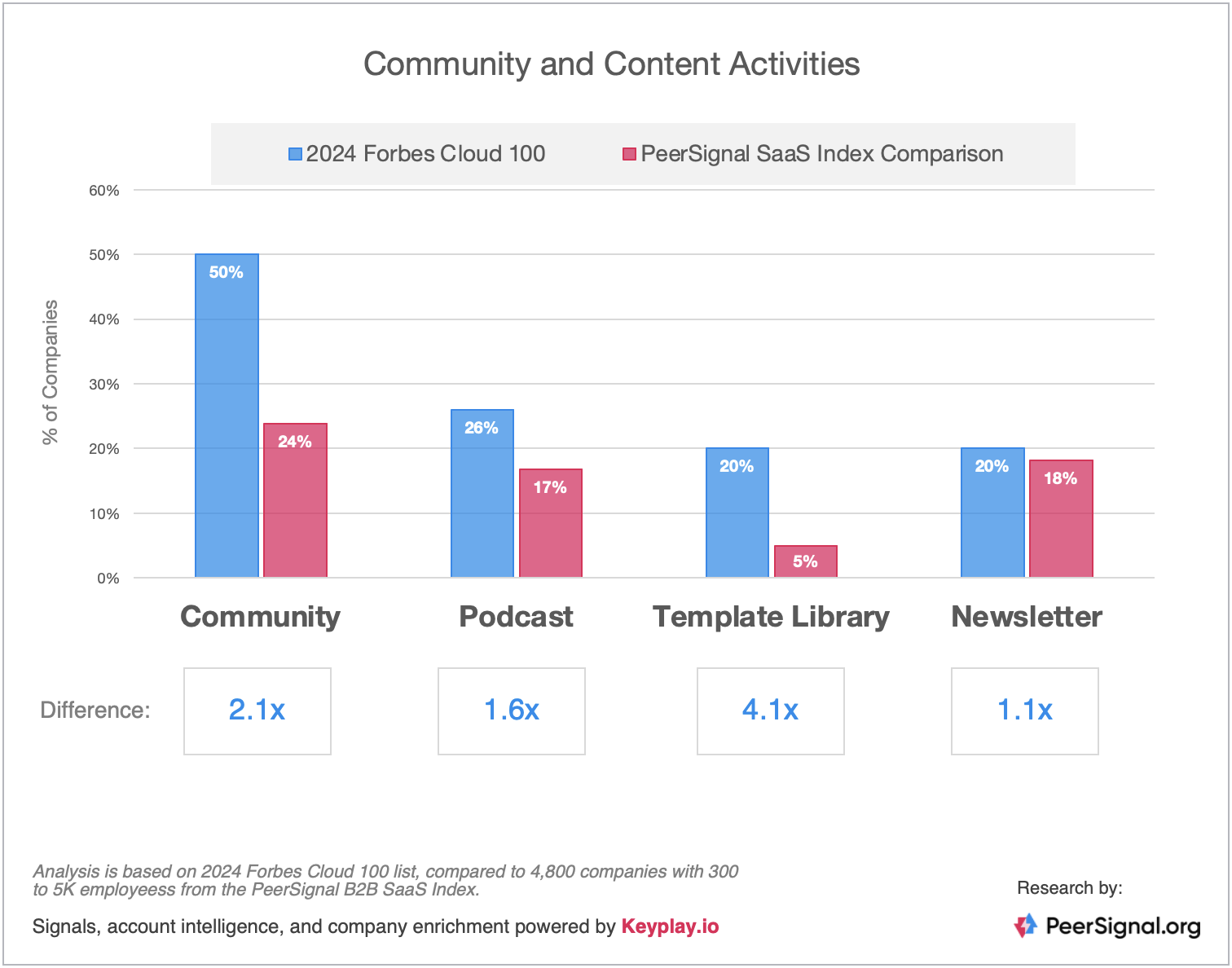

Community-Centric Mindset

Market leaders continue to prioritize community. 50% of Cloud 100 companies have some form of an owned community for customers, users, or a community of practice, 2.1x more than the comparison group.

|

We also see Cloud 100 investing in many of the content strategies that are related to building an engaged community and strong brand. Examples like Notion and Webflow are community-centric Cloud 100s that I follow closely.

Bottom line

The 2024 Forbes Cloud 100 isn’t just a list; it’s a glimpse into the next generation of SaaS leaders. From AI to PLG to strong brand strategies, this group is setting the standard.

What else should I analyze and compare?

Let me know in the comments on LinkedIn.

I'm happy to add columns to the spreadsheet and will keep digging where you see value.