I'm excited to introduce the GTM Tech 1000 (v1.0).

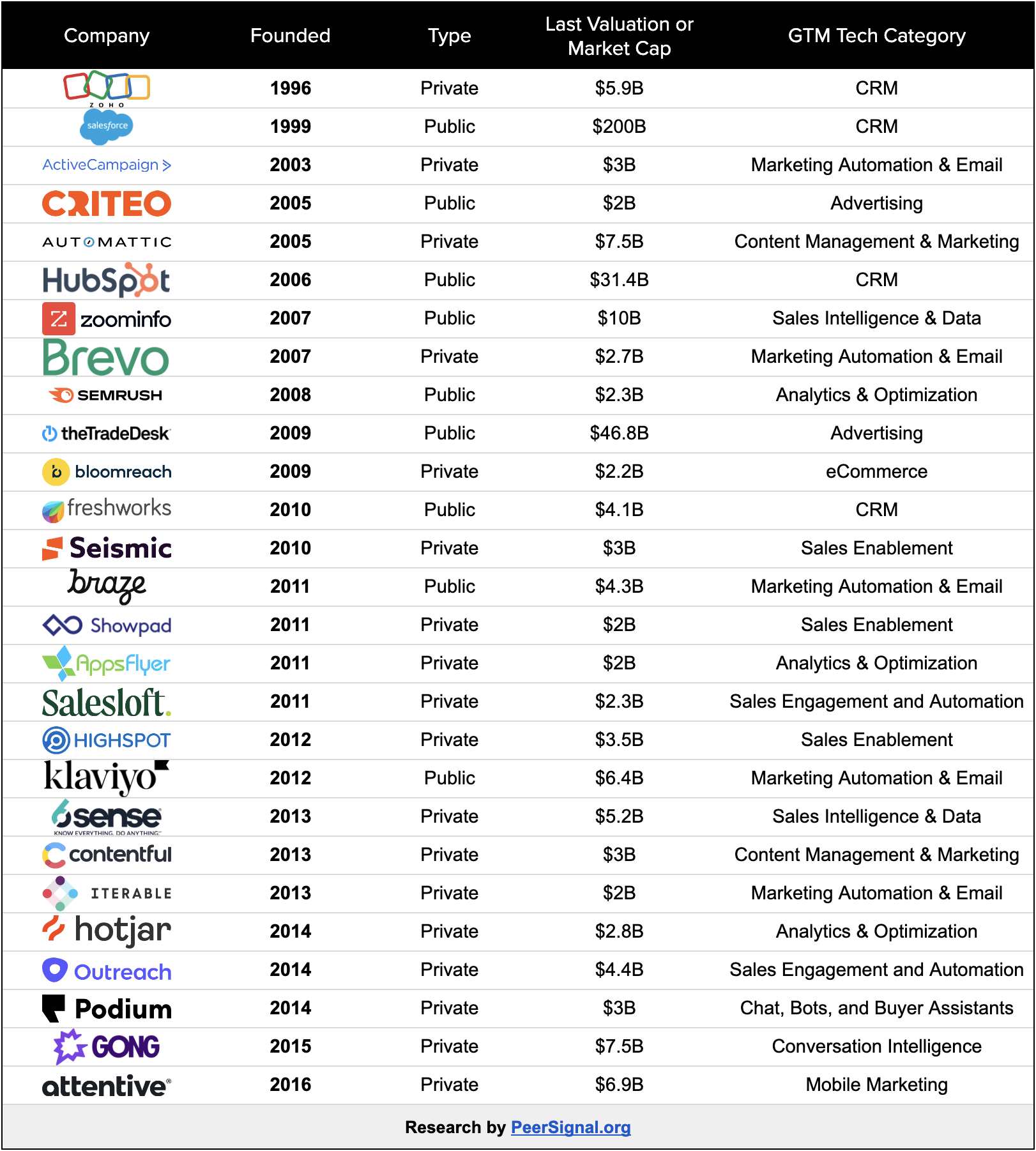

We started with ~8,000 sales/mar-tech companies and curated this 1,000 company dataset for ongoing research.

The full spreadsheet is free for PeerSignal members to explore and download.

Our goal is to represent modern GTM tools and playbooks. That said, I’m sure there are some exciting companies or sub-categories that we haven’t found yet. We plan to expand regularly with your help. Two ways to contribute:

Tag your favorite sales/mar-tech companies on this post.

Or, add them here.

As we dig into this space, a few themes are stand out...

GTM is a very big, dynamic SaaS category

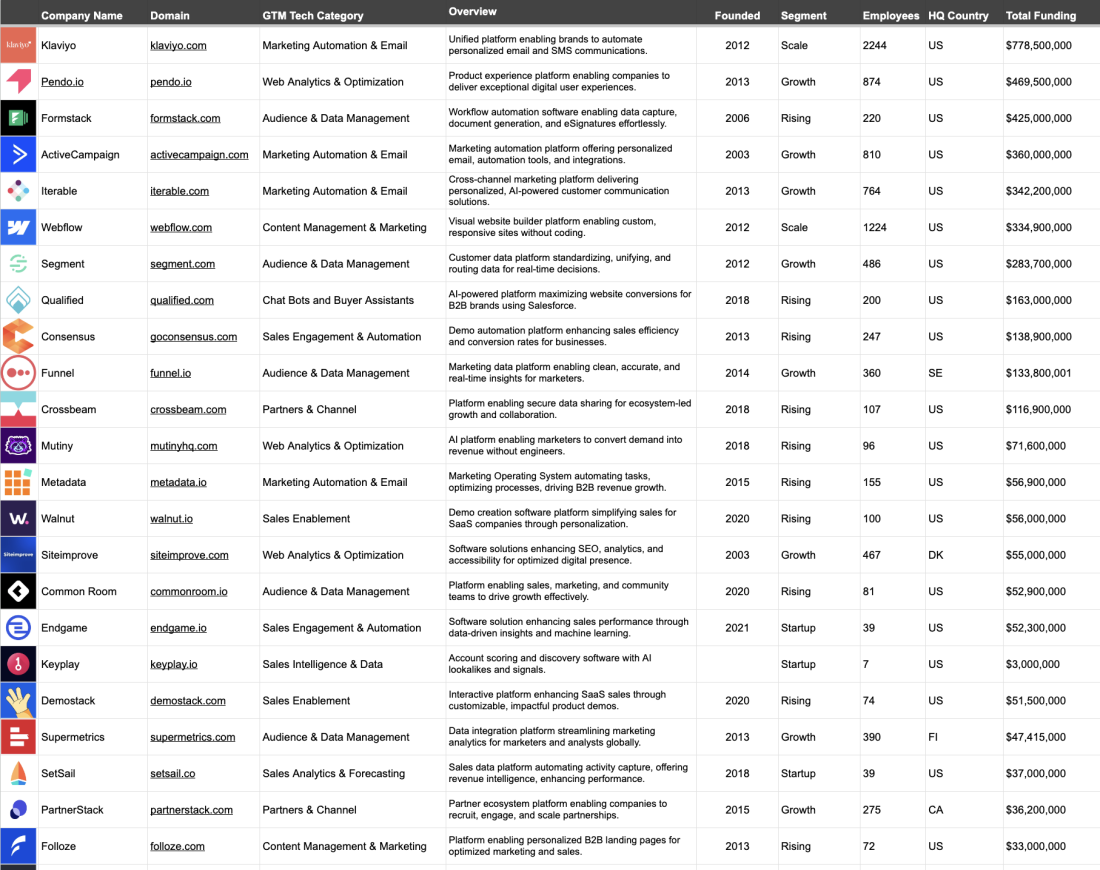

When I think about software, Salesforce is the first company that comes to mind. Last week's 20% stock price slide aside, SFDC is a juggernaut of SaaS and a prototypes for the cloud era. They aren't alone when it comes to big tech with big bets on GTM software. Nearly all of the big tech conglomerates play here (MSFT, Google, Oracle, SAP, etc). And we've identifies at least 20 private companies with a $2B+ valuation.

Note: We intentionally excluding Adobe, Oracle, Microsoft and companies who aren’t pure plays from the table above.

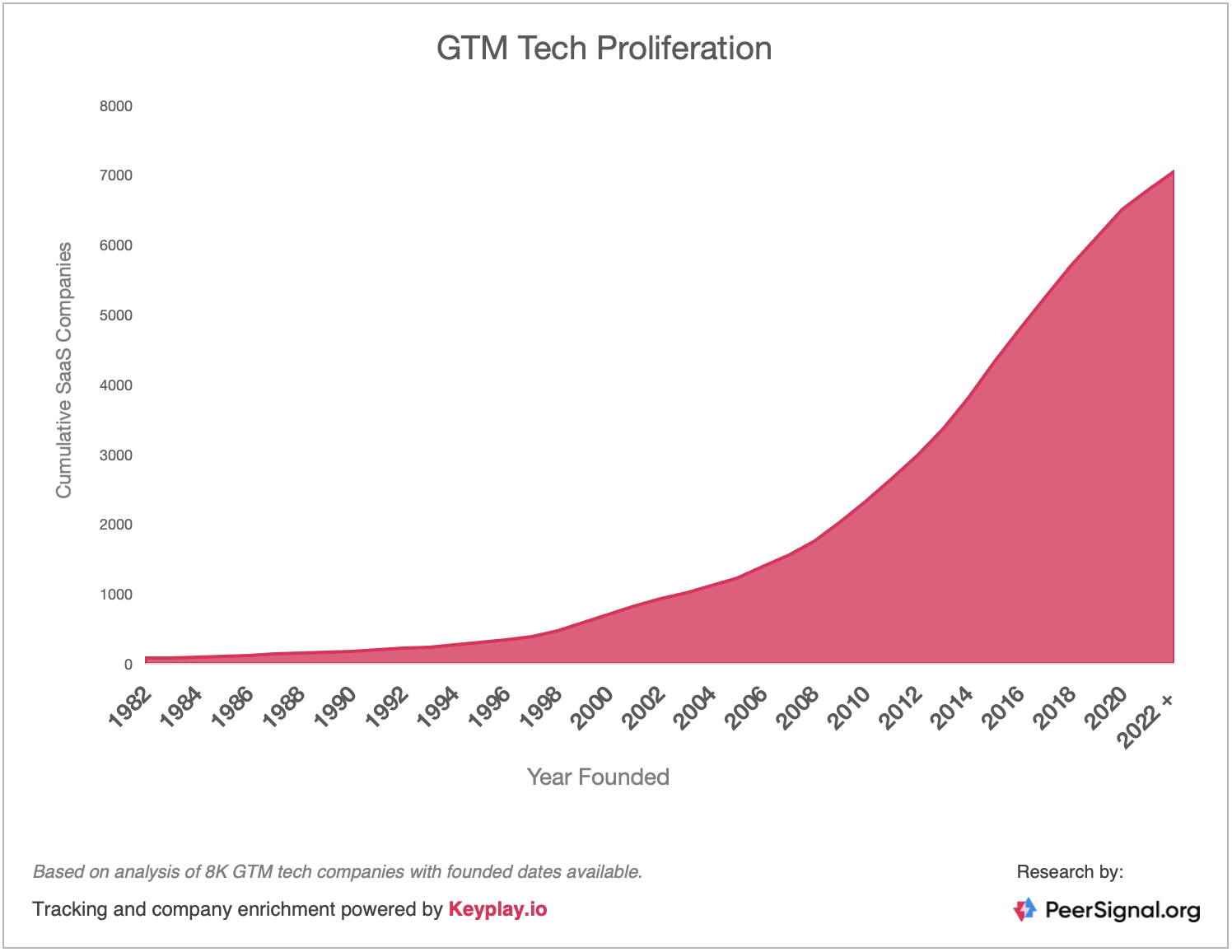

Despite predictions of consolidation, GTM tech keeps fragmenting

I've been working in this space for ~15 years. If I had a nickel for every time experts tal about consolidation, I'd have a 1 bitcoin worth of nickels. While we've seen tons of M&A, the number of products and vendors just keeps growing.

Scott Brinker’s latest map showed acceleration Y/Y!

Chiefmartech identified 14,106 in 2024. We’re focused on ~8,000 companies. Our approach is narrowing in 3 ways : A.) We exclude horizontal products (eg Asana, Tableau, etc). B.) We count companies instead of products. C.) We focus on companies with 5+ employees.

In our data, the story is the same:

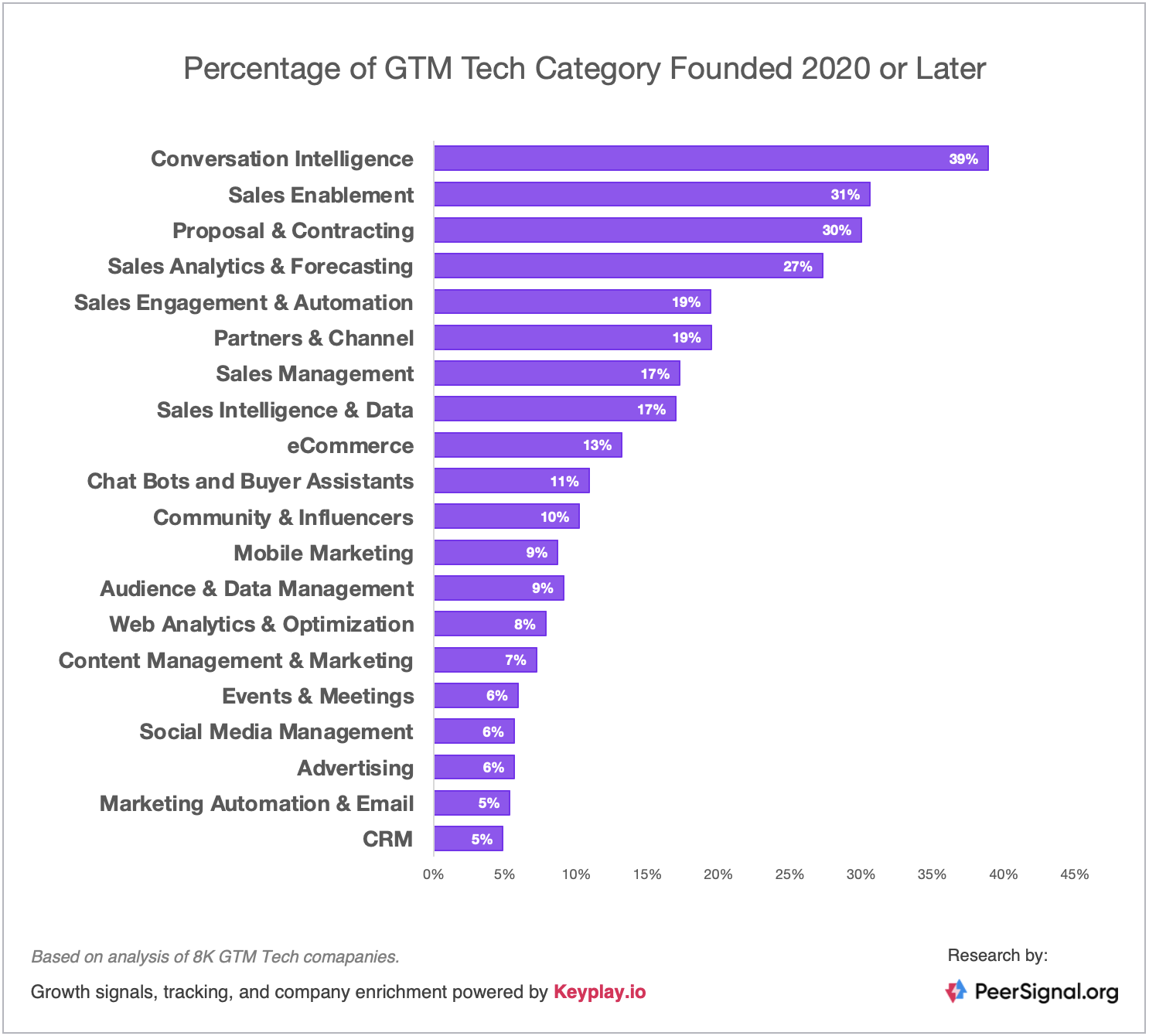

Looking at concentration of "young" companies by category was also interesting. While we continue to see new challengers in older categories like Marketing Automation & Email, there is a high concentration in newer areas like Conversation Intelligence. We can see how new categories get competitive quickly.

AI is changing the game (again)

We've talked a lot about AI infiltrating SaaS.

If you've been in this space for awhile it's not your first "paradigm shift." Change is the only constant in marketing and sales tech.Websites, search, and email brought inbound. Then social + mobile, ABM, PLG. Now AI.

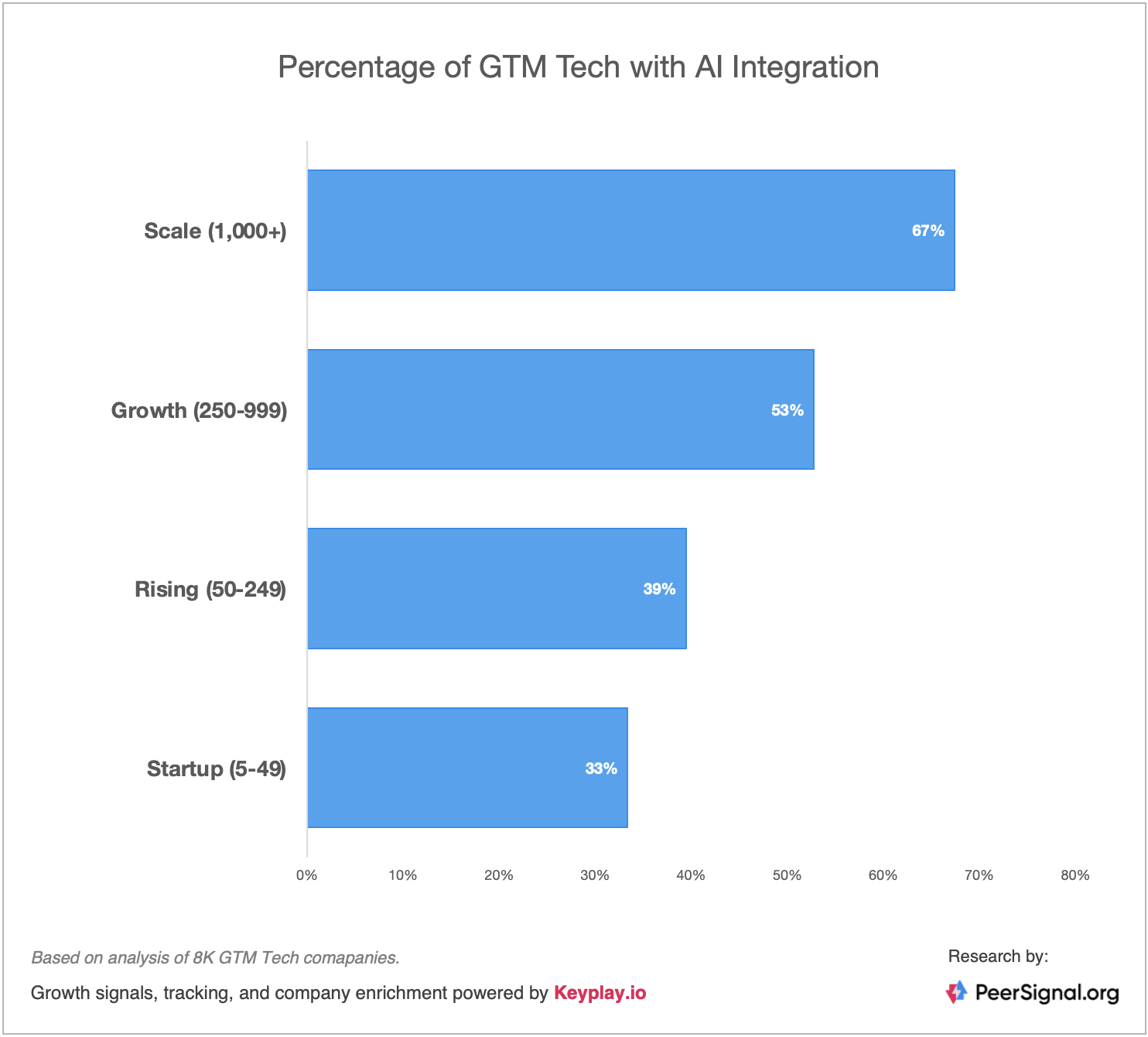

36% of all GTM Tech companies now have some AI integration or messaging. Interestingly the biggest sales/mar-tech companies have been fastest to bring AI into their products and messaging -- over 1/2 of the Growth and Scale segments have AI front and center today while about 1/3 of startups are promoting AI products.

I'm an AI optimist. I think it's over-hyped in the short-term, but underestimated in the long-term. At Keyplay, I'm betting big on this wave, building around LLMs to improve account scoring, enrichment, and ABM workflows.