HubSpot CRM doesn’t get enough love. In this newsletter I’m going to share new data on HubSpot’s surprisingly strong traction (vs Salesforce) and why I’m betting on their platform.

If you’re a HubSpot CRM user, I'm excited to introduce Keyplay’s new integration.

Other ABM vendors neglect HubSpot users:

They write off you off as "not serious."

They worry about scaring you with their monster prices.

They focus on Salesforce, treating HubSpot CRM as a second class integration.

Keyplay for HubSpot is filling the void.

If you like our approach, consider leaving a comment here to help spread the word. 🙏

The $2B ARR underdog

Despite their track record and strategic clarity, many commentators still consider HubSpot a "dark horse." This is especially true, when evaluating their potential beyond the inbound marketing niche.

As I talked to customers, built Keyplay’s integration, and dove into the ecosystem, I was inspired to study HubSpot as a SaaS role model. Let’s start with some impressive bullets:

$2B ARR, growing 30% Y/Y at scale.

184,000 customers.

Haven’t missed an earnings since going public.

IPO’d at ~$900M, trading at ~$25B today.

Incredible pace of innovation. Almost entirely building themselves rather than acquiring a bundle.

Nice inbound tool, but is the CRM for real?

Despite those facts, doubters might still say: “Ok ok, that’s cool, but aren’t they just an inbound marketing tool? Isn’t their CRM some sort of free tool or some kind of novelty for super tiny companies?”

On the surface, this argument holds some weight. HubSpot’s CRM market share is estimated at 2-7%, and it doesn’t even appear in IDC’s chart, which highlights Salesforce’s long-standing domination:

Salesforce has earned its dominance for good reasons: pioneering cloud computing, offering a robust platform with multiple market-leading products, and running an enviable go-to-market strategy.

Where HubSpot CRM Shines

But if you look deeper, HubSpot’s long-term strategy begins to reveal itself.

First CRM for the Next Generation

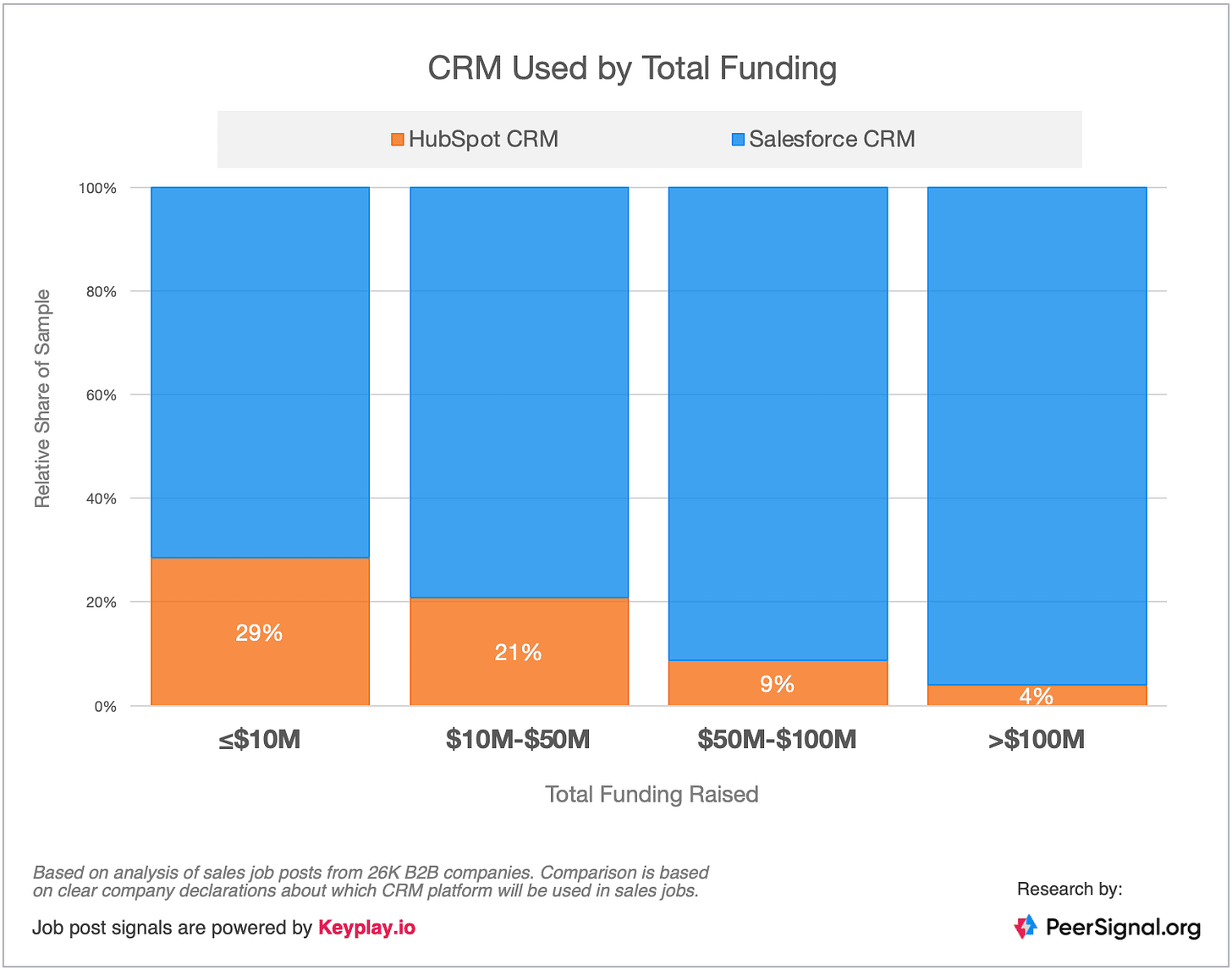

For this analysis, we used Keyplay tech signals and analyzed job posts from tens of thousands of companies to compare HubSpot CRM with Salesforce CRM adoption among growing B2B firms. I won’t claim that this data has the entire picture, but it’s an interesting sample of early adopters.

Skeptics might peg HubSpot as a seed stage platform that requires graduation to Salesforce by series A or B. Our analysis shows HubSpot's relative position remaining strong into the $10-50M funding bucket.

Note: That 20%+ is a very higher number considering Salesforce's dominance in all the market share report.

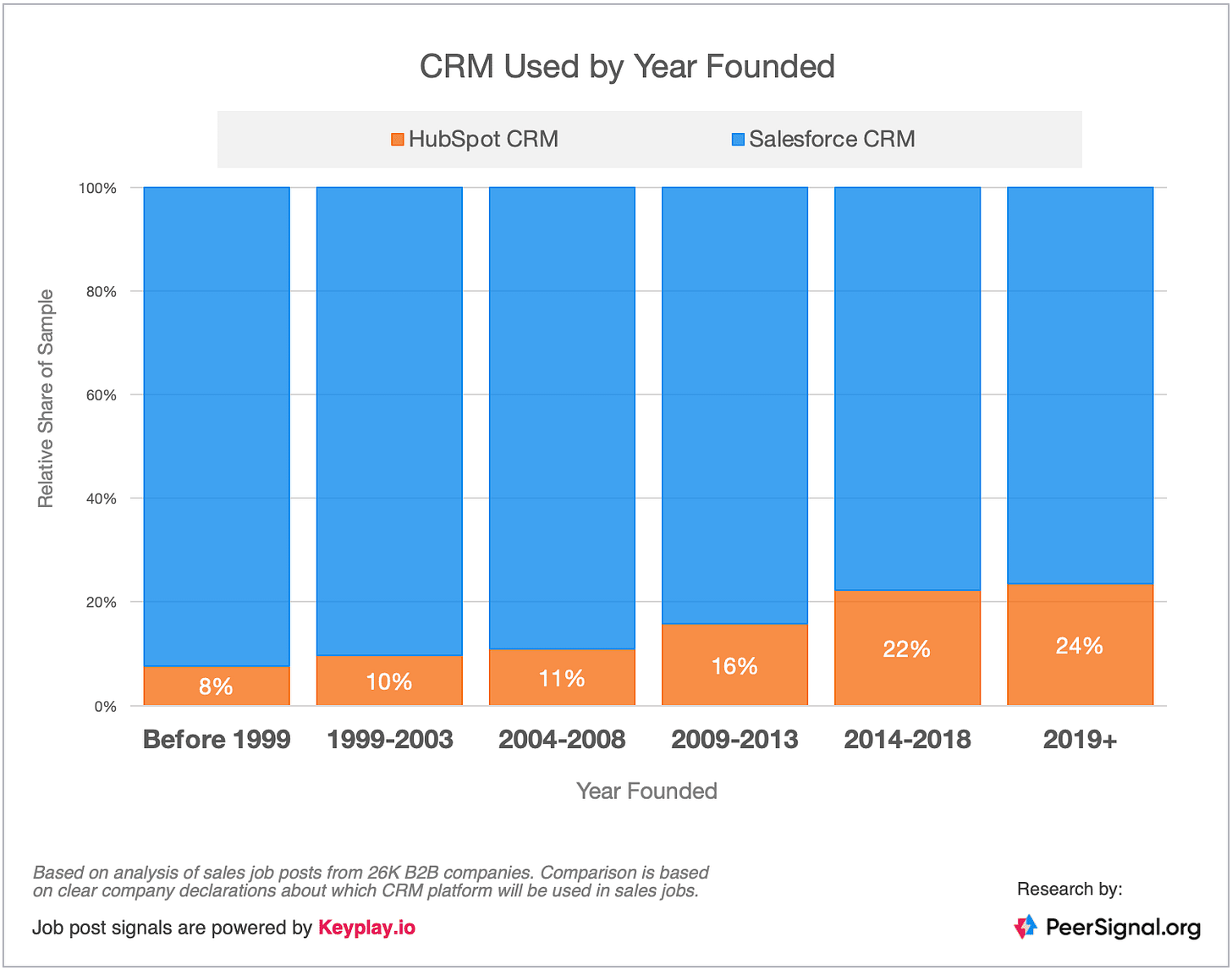

When we slice by founding date, we see newer companies leaning toward HubSpot.

They are well-positioned to be a startup’s first CRM. Many will eventually switch to Salesforce as they scale, but with each new wave of startups, HubSpot could gain a larger share of the market and higher likelihood of retaining these accounts as they grow. Jason Lemkin drew a similar conclusion in a SaaStr blog post last year.

Seat Growth and Customer Growth

We see this in HubSpot's investor presentations as well. At last year’s analyst day, they reporting seeing 100% growth in 100+ seat accounts. That's definitely more of the M in SMB:

Okta’s recent report on fastest growing apps supports this narrative. HubSpot was #1 in sales and marketing and amongst the top overall apps for user and customer growth.

“Hubspot, with 60% YoY customer growth and 96% YoY growth in unique users, leads the way in the sales and marketing category.”

This kind of seat growth is another clue that HubSpot can beyond the marketing team into sales and service departments.

Customer Love

Another area where HubSpot stands out is customer satisfaction. While skeptics question its focus on SMBs, users are overwhelmingly positive about their experience.

I did a straw poll on LinkedIn last week with 1,200+ votes. The breakdown showed the love.

Many of the commenters highlighted just how far HubSpot CRM has come.

HubSpot also receives high praise in G2 reviews. While not necessarily correlated with customer count or revenue, the CRM grid paints a nice picture:

A Second CRM Juggernaut?

All of the above makes me super interested to watch HubSpot’s strategy unfold.

I don’t think their game is “replace Salesforce.” But I would bet on them to:

1.) Win the startup and SMB segments.

2.) Stay with their customers longer (i.e. fewer and slow “graduations” to Salesforce).

3.) Achieve multi-billion dollar ARR business with Sales Hub + CRM.

This bet is part of the reason I’m excited to build Keyplay on the HubSpot platform.