G2 winners analyzed

2 mins read

Before diving into today's analysis, could you quickly hit reply with “got it” so I can confirm deliverability?

I made some DNS tweaks and want to make sure big tech still puts us in the inbox. 🤞🙏🤞

G2 published their Spring 2024 grid reports last week. I was excited to see Keyplay land as a High Performer in our first grid with 4.8/5 stars, amongst the highest satisfaction in our category.

This got me wanting to better understand the top companies on G2—who they are, how they go-to-market, and what we can emulate.

In this newsletter, we study the G2's winners..

We analyzed 300 products that reached G2’s “best for 2024" lists across three categories: highest satisfaction, fastest growing, and best software products. We then compared G2 winners with our broader B2B Software Index (~5K companies) to better understand what makes them tick.

For spreadsheet jockeys & social supporters:

➡️ 1.) Top take-aways on LinkedIn. Comments are always appreciated.

➡️ 2.) G2 winners are aggregated and enriched in this ungated spreadsheet for you.

Here's what stood out in our analysis...

Startups can win on G2

It’s rare to see startups show up in Gartner quadrants or Forrester waves, but smaller orgs can top the charts in the user-drive format on G2. 22% of the winners analyzed have <50 employees and 49% have <250 employees.

Naturally the scaled companies have an advantage – multiple products, longer operating history, and larger market presence to drive reviews. That said, we were excited to see Startups and Rising software companies featured in all the G2 winner lists.

Embracing PLG and Community

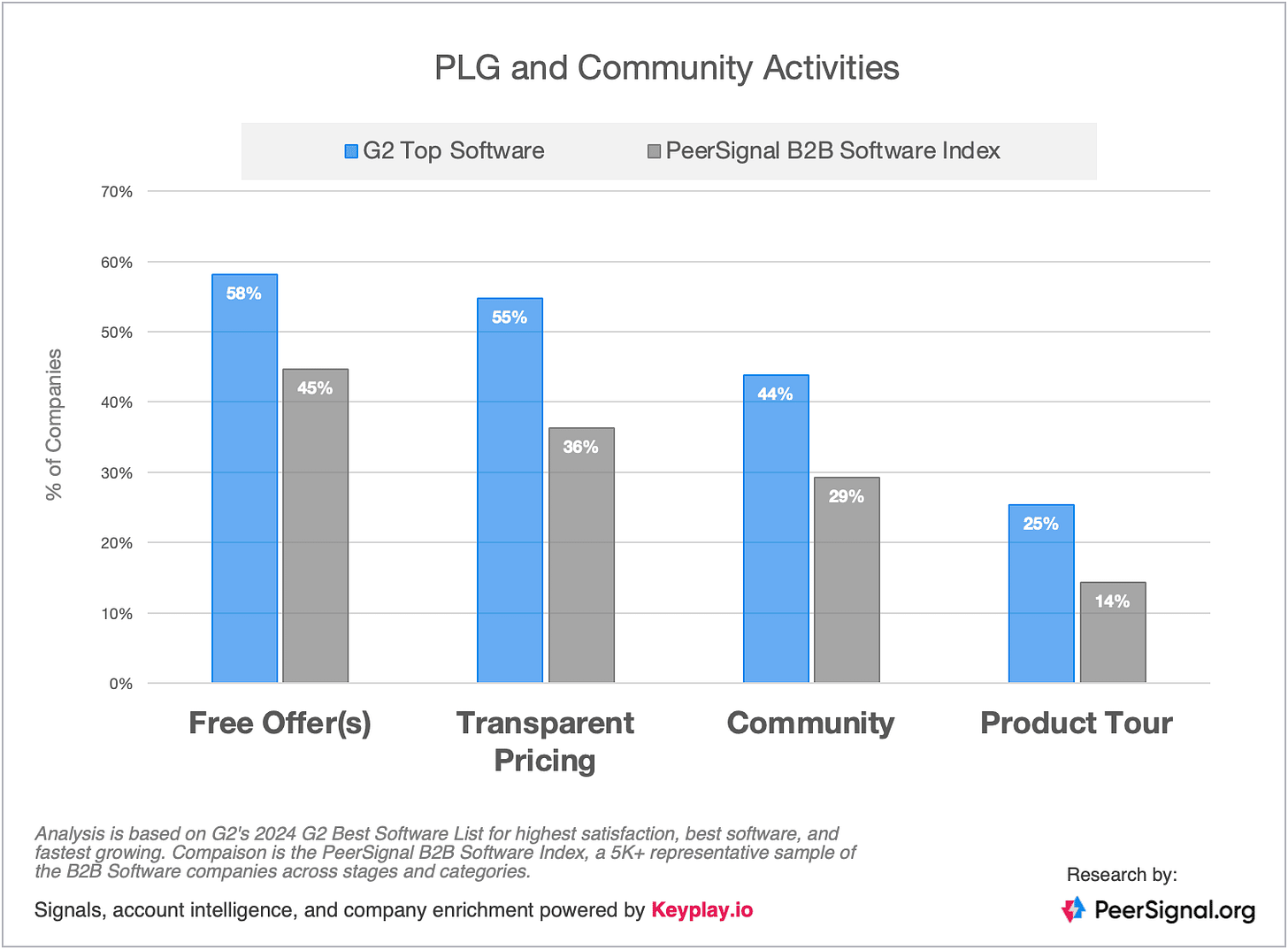

The G2 winners are prioritizing PLG and Community strategies at a higher rate than the typical SaaS company. 58% have a free plan or free trial vs 45% in our index. 55% have transparent prices vs 36% in our index. 44% have some kind of owned community vs 29% in general.

There is a common sense explanation for this correlation – having an engaged community and/or large user base means you have more potential reviewers. If you want to win your category on G2, a strong PLG and/or community strategy might be the key.

Riding the AI Wave

We’ve talked about AI infiltrating SaaS at insane speed. It keeps climbing fast. 54% of our index now promotes some kind of AI angle, but the G2 top companies are even more AI integrated. 63% of G2 winners analyzed prominently message AI on their website.

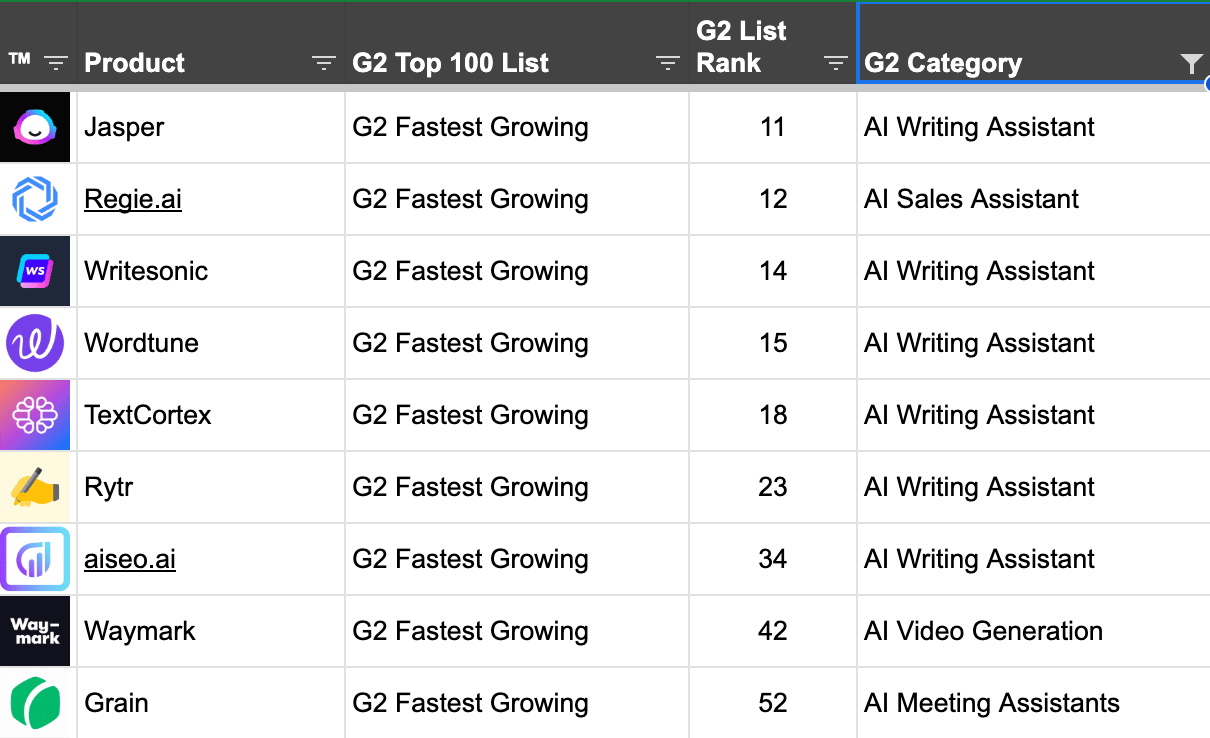

Not surprisingly, many of the top products for 2024 are AI native companies like Fathom, Murf.ai, Synthesia, or Jasper. AI companies dominate the "fastest growing" list -- assistants, copilots, and AI-integrated SaaS products.

Leaning into Partners and Ecosystem

Multiple clues that suggest G2 winners are prioritizing their ecosystem a bit more than the average SaaS company.

53% have a partner program vs 44% in our index. 42% market multiple integrations vs 29% in our index. 40% have a public API vs 35% in our index. G2 winners don't do it alone. They build partner programs, engage 3P developers, and integrate their product's into customer's tech stacks.

Wrap-up

We see that winner companies have a clear emphasis on PLG, community strategies, AI integration, and ecosystem focus. This can act as a blueprint for what makes a software company successful today.

For those of us navigating the B2B space today, it's a reminder that understanding the paradigm shifts, pursuing modern GTM strategies, and playing in the broader ecosystem isn't just good practice, it's essential for staying ahead. And it's possible for smaller companies to build a groundswell of user support to stand out against incumbents.

Check out the spreadsheet to find role models and explore G2 winners in more detail. I'm excited to keep studying these companies and applying their lessons.